Mastering Diversification: Essential Strategies for High Net Worth Financial Advisors

Diversification is a cornerstone principle in wealth management, especially for high-net-worth individuals who aim to safeguard and enhance their investment portfolios. Effective strategies not only mitigate risk but also optimize returns over the long haul. For high-net-worth advisors, mastering diversification is pivotal in ensuring client success and satisfaction.

Understanding the Basics

Diversification encompasses the distribution of investments across various asset classes, industries, and geographical regions, aiming to reduce exposure to individual assets or risk factors. This strategy balances risk and returns by allocating resources across various opportunities. High net worth financial advisors can leverage diversification to bolster portfolio stability and resilience against market fluctuations.

Tailored Asset Allocation

Crafting a diversified portfolio commences with a comprehensive assessment of the client’s investment goals, risk tolerance, and time horizon. Financial consultants must customize asset allocation strategies to meet clients’ needs and preferences. By diversifying across various asset classes, advisors can construct portfolios that deliver consistent performance while mitigating downside risk.

Embracing Alternative Investments

In today’s intricate investment landscape, high-net-worth individuals explore alternative asset classes to enhance diversification and access new sources of returns. These may include private equity, hedge funds, venture capital, and commodities. Integrating alternative investments into a diversified portfolio can furnish uncorrelated returns and reduce overall portfolio volatility, enhancing client risk-adjusted returns.

Dynamic Rebalancing

Diversification is an ongoing process that necessitates periodic rebalancing to maintain desired asset allocations. These consultants must adopt a dynamic approach to portfolio management, regularly reassessing client objectives and market conditions to adjust asset allocations accordingly. By rebalancing portfolios in response to changing market dynamics, advisors can ensure clients remain well-positioned to achieve their long-term financial goals.

Risk Management Strategies

While diversification can mitigate systemic risk, these financial consultants must implement robust risk management strategies to safeguard client wealth against unforeseen events. This may involve hedging strategies, options strategies, and insurance solutions tailored to individual clients’ specific needs and risk profiles. By incorporating risk management techniques into the framework, advisors can protect client assets and provide peace of mind in volatile market environments.

Active Manager Selection

The selection of investment managers is pivotal in the success of a diversified portfolio. Financial consultants must conduct thorough due diligence to identify skilled, experienced managers capable of delivering consistent risk-adjusted returns. By partnering with top-tier investment professionals across asset classes, advisors can access specialized expertise and insights to optimize portfolio diversification and performance.

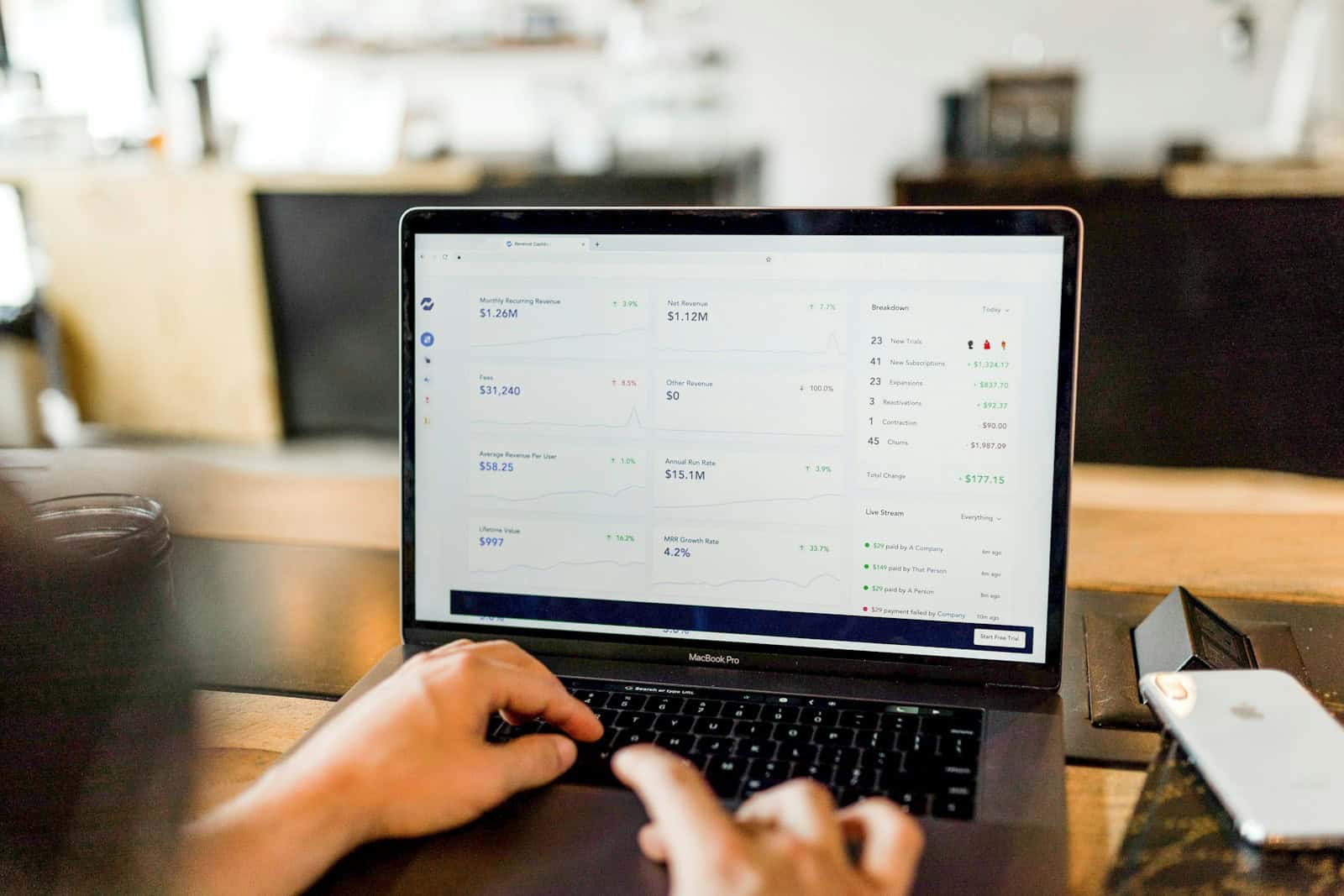

Leveraging Technology and Analytics

In today’s digital era, technology and data analytics are indispensable tools for financial consultants striving to master diversification. Advanced portfolio management platforms and analytics software empower advisors to conduct in-depth portfolio analysis, monitor performance metrics, and identify diversification opportunities in real time. By harnessing the power of technology, consultants can enhance decision-making processes and deliver superior outcomes for their clients.

Education and Communication

Effective communication is vital to ensuring client understanding and buy-in to diversification strategies. These financial advisors must educate clients about its rationale, benefits, and potential trade-offs. By fostering open and transparent communication channels, advisors can build client trust and confidence, empowering them to remain committed to their long-term investment objectives despite short-term market fluctuations.

Mastering diversification is crucial for High net worth financial advisors to navigate today’s intricate investment landscape. By employing these strategies, advisors can diversify portfolios and optimize long-term outcomes.